Reduce Fraud with 3D Secure 2 Payments Powered by the Merchant Warrior Payment Gateway

We’re excited to announce that 3D Secure 2 payments are now available through our close collaboration with Australian payment gateway partner, Merchant Warrior.

This added layer of security helps reduce fraudulent transactions resulting in fewer chargebacks for Property Managers, offering greater peace of mind for both you and your Guests.

What are 3D Secure 2 Payments?

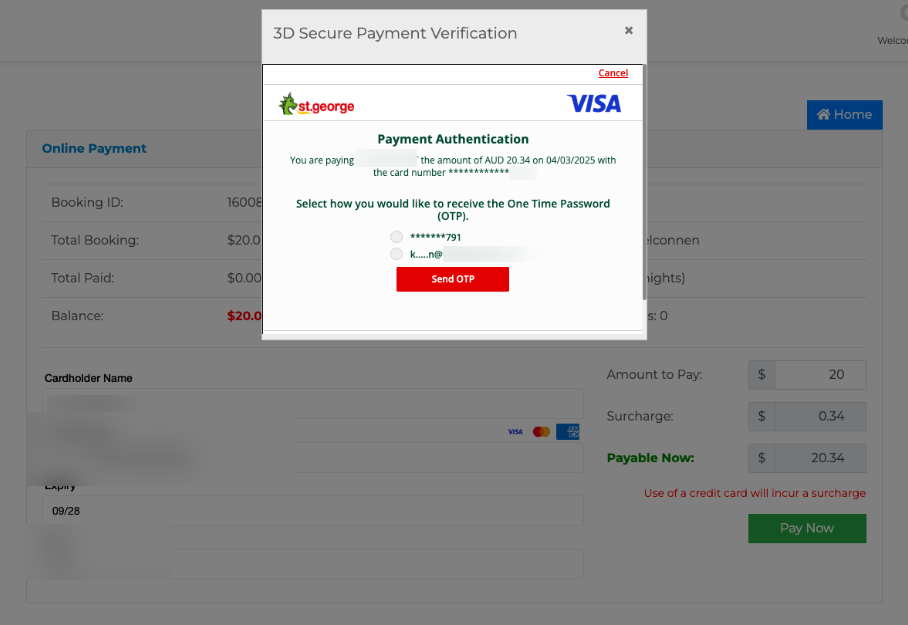

3D Secure is a security protocol that adds an extra layer of verification to online credit card transactions. This requires cardholders to authenticate their identity before a transaction is approved, in this case through a One Time Password (OTP) sent via SMS to the credit card holder’s mobile phone number.

3D Secure 2 vs 3D Secure 1: What’s the Difference?

3D Secure 1, or 3DS1, was the original version, introduced all the way back in 1999. As such, the technology is dated and somewhat clunky, requiring customers to set and remember a password to enter to transact online. The 3DS1 process often redirected customers away from checkout to enter their password before being redirected back again if successful, leading to higher rates of abandonment as users struggled to remember their passwords.

3D Secure 2, or 3DS2, introduces smarter authentication challenges and seamless payment experience for Guests, with a particular focus on the user experience on smartphones. Rather than having to remember a password, with 3DS2 customers can authenticate using a code sent by SMS or their online banking app, with the security challenges embedded directly into the checkout. 3DS2 also introduces frictionless authentication, whereby transactions identified as low-risk can go through without a 3DS2 challenge at all.

How does 3D Secure 2 Work?

At the time your Guest makes a payment online the payment is authenticated in real-time by the cardholder’s bank, ensuring that only authorised transactions are processed. This not only strengthens payment security but also enhances trust and reduces risks, creating a safer and more seamless experience for everyone involved.

The flow of events facilitated automatically when 3D Secure payments are implemented is as follows:

Merchant initiates the transaction: When a Guest (i.e. the cardholder) attempts to make a payment online, the merchant initiates the 3D Secure process.

Card issuer verification: The card issuer (the bank that issued the credit card) is notified and prompts the cardholder with an additional verification step, the validation of a One Time Password (OTP).

Cardholder authentication: The cardholder is redirected to a secure page on their bank’s website or mobile app, where they must enter the OTP.

Transaction authorisation: Once the cardholder successfully authenticates, the card issuer authorises the transaction, and the merchant can process the payment.

Why is 3D Secure 2 Important?

With the rapid increase in fraudulent transactions and chargebacks occurring within the Short Term Rental Accommodation sector, costing many property managers across the nation thousands of dollars every year, implementing 3D Secure offers a robust layer of protection against credit card misuse.

Three key areas your Property Management Company will benefit from with 3D Secure in place are:

Reduced fraud: By requiring an extra layer of verification, 3D Secure makes it more difficult for fraudsters to make unauthorised purchases.

Improved security: It protects both cardholders and Property Managers from fraudulent transactions.

Increased trust: 3D Secure can build trust between Property Managers and Guests, as it demonstrates a commitment to security.

Are there any drawbacks with 3D Secure 2?

Whilst the benefits of 3D Secure 2 are clear when it comes to reducing fraudulent transactions, the main risk identified with 3D Secure payments the added step in the payment process causing the occasional customer to abandon their purchase. It is worth high-lighting that this issue was more prevalent with 3D Secure 1, which

HomHero, Merchant Warrior and the 3D Secure 2 technology itself mitigate this risk on your behalf, as the OTP process isn’t part every single transaction within a 3D Secure 2 payment environment. Only those transactions flagged by the card issuer as a high-risk due to factors such as unfamiliar IP addresses and uncharacteristic credit card usage trigger the OTP process. In fact, as little as 20% of total transactions through your payment gateway will actually involve the OTP process.

How to Activate 3D Secure 2 Payments

If you are an existing HomHero client and wish to activate 3DS2 in HomHero, please view the knowledge base article below for further information on how to get started:

How to activate 3D Secure utilising the Merchant Warrior payment gateway